With driverless cars, insurtech could hinge on the software and automation tech behind the self-driving cars

The concept of driverless cars gained traction when corporate powerhouses like Google and Uber decided to invest in it and help this seemingly utopian and futuristic idea transform into an economically viable reality. However, the primary concern at this point that refuses to fade away from the limelight is that this new era of autonomous driving technology would end up affecting auto insurance companies.

A lot has been said on how the introduction of driverless cars or even autonomous drivers and assistance systems would spell doom for insurance firms, mainly because driverless cars are a big part of humanity’s final push to achieve the ultimate economic dream, i.e., utopian efficiency.

Driverless cars hinge on the recent, yet mind-boggling advances, achieved in the field of artificial intelligence. This mainly is due to the deeper understanding of how to better utilize neural networks and make even bigger dreams come true.

AI is not what Hollywood makes it appear

AI, in the popular imagination, led by countless depictions of “conscious” computers in Hollywood staple sci-fi genre, has led many to believe that someday, there will be a sudden transformation – the way we interact with our machines would change forever.

People innocuously assume that these “conscious computers” would trump every possible and perceivable problem of efficiency ranging from achieving zero road accident to hospitals without doctors.

No longer would humans be required to deal with trivial, cumbersome tasks like driving cars or even switching on lights, as everything will be done automatically, in the most realistic possible sense of the word. And is there is any room for a costly safety net like automobile insurance, to save us from things that we believe would never transpire? Definitely not. Hence the doom and gloom predictions on how the insurance industry would come down collapsing like a house of cards.

But, there is a difference between movies and reality and things don’t really look that bleak here. AI-powered autonomous driving assistance systems are here, but they are not immune to damage, yet. Even these futuristic cars have experienced crashes.

Yes, our roads are definitely bound to become safer with these autonomous driving aids inside the cars of tomorrow. There were 38,300 deaths on U.S roads in 2015, and driverless vehicles would help us bring those figures down, but to achieve almost ‘zero deaths’ is taking the bet too far.

Insurance premiums would definitely come down as autonomous driving aids make our roads safer. However, they won’t cease to exist.

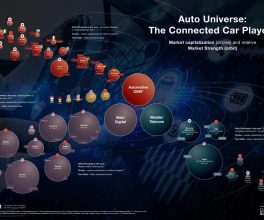

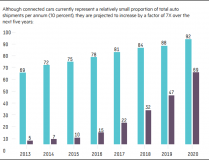

Conventional forms of doing business in insurance firms are probably going to take a severe plunge in revenues. Goldman Sachs predicts that 60% of auto sales in U.S will be generated through driverless cars by 2030, but as with most disruptions, a new form of insurance could evolve out of this whole scenario –one in which the software inside the car, instead of the actual car, ends up demanding more insurance cover, making the future retain a silver lining for insurance companies across the globe.

Volvo, one of the more prominent players in the driverless cars arena, said in 2015, that it will accept full liability for any crashes that its autonomous cars might get involved in. This makes traditional insurance look like it’s indeed headed towards doom if nothing spectacularly creative isn’t generated to reverse the scenario by insurance firms.

Current business models of insurance firms would need to evolve if they want to remain even remotely profitable entities in the upcoming decades. Simply put, insurance firms need to move out and check on the possibilities that new frontiers provide.

Upcoming technologies, which include Internet-of-Things (IoT) connectivity, real-time data collection, and analytics, can help keep better track of vehicles’ whereabouts and activities. Coupled with driverless car technology, this could help reduce insurance premiums and even determine liability in the event of accidents. For instance, Streamr, which is building its decentralised platform for managing data and distributed applications, has partnered with companies like Rolls Royce, in order to track and analyze real-time IoT data from in-car sensors.

But what are the risks involving automation?

From the onboard AI going rogue or a malfunction in the built-in wiring of the computer systems to the onboard AI wrongly anticipating a move by a vehicle in front of it, driverless cars do pose some degree of risk. And this is this exact same risk that insurance companies need to hound to ensure that they don’t bow out of the system, fading away like an alien concept that refused to align itself with the rapidly changing environment.

For insurance firms, it’s better that they collaborate with businesses that are developing driverless systems and move away from their law-backed, current mechanism of enforcing individuals to take up their product.

Just like Volvo, one of the more influential players in the autonomous arena, i.e., Tesla has been selling its cars in Asia, with insurance included in the final price. This is a bid by these tech firms to make their cars appear more appealing to general consumers across the spectrum. Insurance firms can side with these tech firms by leveraging the risk and keep their ships afloat. And opportunities in this regard won’t be inconsequential.

It’s not just driverless cars, but tech firms are also looking to automate trucks. Tesla recently announced that its master plan would also include semi-trucks as well, while other trucking manufacturers are also looking to bring autonomous vehicles to the market, notable mentions being Google’s Waymo project and Uber’s Otto, with the latter completing a successful 120-mile journey autonomously on a public highway. This represents growing opportunity for insurance firms to capitalize on mitigating the new kind of risks that these exclusive technologies could generate.

For insurance firms, starting up a collaboration, even that is experimental in nature with tech giants like Tesla, could help them move and adapt their business models to the changing environment and be ready for the change till it finally arrives.

The passenger would probably never take responsibility for a crash in an autonomous vehicle, and it’s the car itself that would have to take the blame. And in there, lies the chance for insurance firms to renew their chances for success in the upcoming decades.

It is crucial that the manufacturers take the right steps and ensure that problems such as accidents and crashes do not happen when autonomous vehicles are in action.

If the cause of a crash is not the driver, then the driver will cease to be a customer for the insurance firms, this is quite simple to understand but will it be done shortly, is anyone’s guess, even mine.

Author – Rachael Everly

Courtesy of E27