How the race to monetize the connected car will drive change in the auto industry

Intel CEO Brian Krzanich declared that “data is literally the new oil” during an address at last year’s L.A. auto show. The idea that bits and bytes will replace petroleum as the primary fuel for the world’s economy—and the auto industry in particular—isn’t an original one. But it summarizes what many insiders believe: As data analytics engines become more valuable than vehicle engines in the coming years, the flood of information gleaned from them will serve as a primary driver of automotive innovation with potentially billions in profits at stake as a result.

Cars are just now becoming connected, and as autonomous technology moves into the mainstream the flow of data will turn from a trickle into a full-blown gusher. Automakers, their major suppliers, and large tech companies are already jockeying to take advantage of what Intel calls the coming “Passenger Economy … when today’s drivers become idle passengers.” But it’s how they properly tap into and cap that well of information that will be the hard part. Krzanich added in L.A. that to discover, process, and market this resource will take unprecedented levels of computing, intelligence, and connectivity.

And as is the case with the oil industry, another issue bubbling to the surface is who actually owns the data and how it will be made secure.

Driven by Data

A report released earlier this year by TrendForce predicts 75 percent of the world’s cars will be connected to the Internet through Wi-Fi by 2020, with estimates of around $2.94 billion in revenue largely from expanded safety technology and consumer convenience offerings. That’s peanuts compared to the $24.6 billion Google earned last year on search-ad revenue. A recent study conducted by Strategy Analytics for Intel found the autonomous vehicle market is projected to grow from $800 billion in 2035 to $7 trillion by 2050, largely driven by the aforementioned passenger economy (ride hailing and car sharing, self-driving delivery services, and pilotless services provided for restaurants, entertainment, etc.).

This explains why the likes of Waymo, an autonomous car development company created by Google’s parent company, Alphabet Inc., and com-petitor Apple are pouring millions into automotive R & D and self-driving cars. It’s also the reason behind automotive supplier Delphi’s recent pivot to primarily becoming a purveyor of car-based data.

After announcing last May that it will spin off its $4.5 billion powertrain division, Delphi’s “core business is now focused on the components and high-speed data that will be needed for vehicles of the future,” says Ben Hoffman, CEO of Movimento, a company Delphi acquired earlier this year that specializes in over-the-air software updates. As part of its overall strategy, Delphi also acquired Control-Tec, a connected car data-analysis company, in 2015. And earlier this year it partnered* with the Israeli startup Otonomo, which Hoffman describes as the “data-monetization side of the equation.” It’s all part of an “aggressive push for Delphi around data, analytics,” Hoffman added.

Carmakers are also looking to cash in by collectively spending billions to beef up their software and data-processing prowess as well as partnering with tech companies to help fill competency gaps. With the help of Microsoft, last year Toyota created a new data analytics division called Toyota Connected to bring Internet-connected services into the car. Earlier this year, Renault-Nissan inked a deal to leverage Microsoft’s Connected Vehicle Platform and its Azure cloud architecture to collect vehicle sensor and usage data in order to develop “connected driving experiences.” Ford recently invested $182 million in Pivotal, a cloud-based software company, in part to create analytics tools and a cloud platform to support the automaker’s Smart Mobility initiative.

A Digital Geyser of Data from Connected Cars

Despite all the hype, today’s cars are creating barely a ripple of data, according to Roger Lanctot, associate director of Strategy Analytics’ Global Automotive Practice. “With the possible exceptions of cars with LTE modules that enable Wi-Fi,” Lanctot says, “the amount of data from cars now is barely ticking into the megabytes range and more often in the kilobytes.”

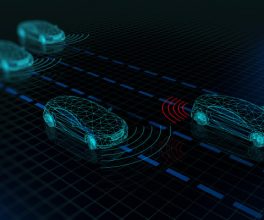

That’s set to change quickly in the next decade or so as autonomous vehicles hit the road. According to a report from Barclays released last spring, a Level 4/5 autonomous car is expected to generate 100 gigabytes of data every second. The Barclays report added that in the U.S. alone 260 million cars will produce about 5,800 exabytes of data daily, enough to fill 1.4 million Amazon tractor-trailer mobile data centers—or a convoy 11,000 miles long.

While Lanctot feels that such figures are overblown, he agrees that a deluge of connected-car data is on the horizon, especially as cameras and other sensors that are becoming de rigueur on cars start to capture more info. “There’s an increasing recognition,” he says, “that all those cameras and sensors are collecting extremely valuable information.”

Although primarily used for self-driving purposes, the data acquired by cameras and other sensors is largely untapped for commercial purposes, Lanctot says. “Fleet operators are realizing that the information about the environment through which the vehicle is driving—whether it’s traffic, weather, road conditions—is extremely valuable. And what if you’re in law enforcement, and there’s a terrorist attack, and you could immediately access the cameras in all of the cars in an area? The power of those cameras is underappreciated and under-leveraged.”

Next Stage in Data Collection

The next stage includes culling information from vehicle components such as engines, transmissions, brakes, and even windshield wipers. Vehicles communicating with other vehicles and roadway infrastructure will add another layer of data.

Cadillac introduced the first production vehicle-to-vehicle communication system on its 2017 models, and last year, Audi launched a Traffic Light Information vehicle-to-infrastructure system that lets its cars know how long a light will stay red or green to help improve traffic flow. The digital mapping company Here, which was acquired by a consortium of German automakers in 2015, has shown how drivers could be warned of heavy rain ahead because cars down the road have their wipers on full speed, and the mobility data company Inrix has developed a system that alerts motorists to the precise location of black ice when the traction control of a car up ahead is activated, for example.

Another rich source of data can come from car occupants themselves. Today an infotainment system can tell which Pandora stations you listen to or the destinations you enter into a cloud-based navigation system and paint a digital picture of driver behavior that’s red meat for marketers. In the future, it will also include predictive maintenance, usage-based insurance, and location-based marketing like OnStar’s AtYourService feature that offers drivers discounts on everything from hotel stays to Dunkin’ Donuts. Data-driven parking solutions that help drivers find a spot in a garage or even on the street are also now on offer from Audi, BMW, and Mercedes-Benz.

In the future, interior supplier Faurecia’s Active Wellness seat could measure heart and respiration rates using embedded sensors and “then take measures to help alleviate stress or drowsiness,” according to the company. Ford has shown a steering wheel that can take your pulse and other vitals, and it’s not difficult to imagine how valuable biomedical data would be to a driver’s doctor, health insurer, or a pharmaceutical company.

With the advent of fully autonomous cars and shared-use robo-taxis, the passenger experience could still be personalized. Bosch is working on a system that uses retina scanning and fingerprint recognition to identify who is entering a vehicle so it can set climate controls, seating position, and radio stations based on a passenger’s preference.

If this is enough to make the tech-averse manual-transmission set consider staying away from new cars, Hoffman points out there are advantages for automotive enthusiasts in this data-driven brave new world. “You could go to a track and with the click of a button enable a software download that changes the performance parameters of your vehicle for that time frame that are modified for an enthusiast experience,” he says. “And when you leave it goes back to the regulatory-compliant mode.”

Although there are already camera-based lap recording features such as GM’s performance data recorder available for a few cars, future upgrades could record your every drive so that you could replay an epic trip on a favorite road or hot lap at the track and even measure it against others. “That’s really compelling from an enthusiast’s perspective,” Hoffman says. “Your performance data could be overlaid on a famous track in a video game to see how your driving performance stacked up against others.”

“Cooperatition” with Google and Others

But some question whether automakers and suppliers, who have had the same business model for more than a century, can transform into data companies and compete with the likes of Google, which has been minting money by processing data to deliver ads and other online services for almost two decades.

“Automakers are still in the early stages of gathering data, analyzing it, figuring out how to get actionable data,” says Brian Johnson, managing director of Equity Research, US Autos, at Barclays Capital. “That doesn’t mean there aren’t smart people starting to work on it. But software has never really been the core competency of Detroit.”

“There’s a misconception that the tech industry has it all figured out since they understand data analytics,” Hoffman adds. He contends that “the automotive industry knows what data is important and what it means to the performance of the vehicle. That’s really the sweet spot and the key value driver that Delphi brings with its automotive expertise and experience.”

Hoffman says the auto and tech industries have also found there’s a lot to learn from one another—and “co-operatition” between the two camps is crucial. “Part of the challenge is for the automotive industry to do more in computing and connectivity and for tech industry to have a better understanding of automotive. Those that blend the two together effectively will be the winners.”

Lanctot contends that the auto industry “needs help packaging and putting a value on the data because they don’t know who to sell it to and what it’s worth. If GM had an inkling of that, they would have been collecting traffic data using OnStar a long time ago. They’ve been trying to use data as a warranty cost-avoidance tool, identifying problems early. Obviously, that didn’t work out too well with the ignition switch problem.”

Approaching a Vehicle Data Tipping Point

Another hurdle, Lanctot says, is that vehicle data processing and analysis require large investment in components and connectivity that will be difficult for automakers to pass on to car buyers. Even though he believes “we’re approaching a tipping point” in terms of the value of vehicle-generated data, “we’re on the uphill and not the downhill side of it. And we’re going to need more powerful processors, greater storage capacity, and better networks in vehicles that are capable of handling this data.” Lanctot also says automakers can’t expect consumers to foot the bill for connectivity. “There’s no way someone is going to pay for 100 gigabytes of data per day.”

Data might indeed be the new oil, but unlike petroleum it’s not a finite resource, and its vast potential is largely untapped in vehicles. Like oil, however, data’s usage in cars will be diverse, lucrative, and also costly to find and refine. And contestants are revving up for a race of resource dominance that will be more of a rally than a sprint.

Roadblocks Ahead?

Despite progress, issues persist around privacy and cybersecurity

Although automakers, Tier 1 suppliers, and tech companies are all making huge investments in connected and autonomous cars, concerns about vehicle cybersecurity and driver-data privacy present a potential roadblock to these ambitious plans. “You can’t have vehicles going autonomous without connectivity, and you can’t have connectivity without concerns about cybersecurity,” says Movimento CEO Ben Hoffman.

Several high-profile hacks have caused the auto industry to be more proactive, including hiring cybersecurity experts and forming an Automotive Information Sharing and Analysis Center (Auto-ISAC). To help safeguard driver data, the U.S. auto industry’s two main lobbying groups released a set of voluntary Privacy Principles in 2014.

These measures haven’t come quickly enough or haven’t gone far enough for policymakers in the U.S. and in Europe. Solid cybersecurity is a prerequisite of recently proposed U.S. legislation on connected and self-driving cars. In July, the House Energy and Commerce Committee approved a bill that contains language to ensure vehicle cybersecurity and driver privacy. During a Senate Commerce, Science, and Transportation Committee hearing this summer on Paving the Way for Self-Driving Vehicles, members proclaimed that cybersecurity “must be an integral feature of self-driving vehicles from the very beginning of their development.”

In August, the British government issued new rules that compel manufacturers of connected vehicles to abide by strict cyber protections and allow drivers to delete personal data. And in June, the German government issued guidelines that state that the manufacturers of automated and connected cars must allow owners to “make decisions about the sharing and use of the data related to their driving.”

Unlike with recalls, automakers can’t take a fix-it-and-forget-it approach to cybersecurity, and any strategy will have to include over-the-air software updates, Hoffman says. “You don’t solve cybersecurity, and then you’re done. It’s an ongoing, ever-evolving dynamic you need to stay ahead of.”

Roger Lanctot with Strategy Analytics noted that the German guidelines governing how automakers can use driver data stipulate that people need to opt in. He points out that, as with other instances of data privacy in our increasingly connected world, the onus is usually on the vehicle user to determine what data is being shared.

“Car companies say the customer owns the data,” Lanctot says. “But the question is how do they get access to it.”

Author – Doug Newcomb

Courtesy of – Automobile Mag