Carmakers, tech companies and ride-hailing firms are all fighting for a piece of the action

IF YOU WANT to buy a fully self-driving car, you may have to wait for another decade. Autonomous vehicles will initially be offered for sale not to private owners but to robotaxi-fleet operators, for two reasons. First, LIDAR sensors are still so expensive that, deployed in production cars, they would cost more than the rest of the vehicle put together. For AVs in a robotaxi fleet, that is less of a problem, because vehicles will be operating, and thus generating revenue, throughout the day, whereas private cars are in use only about 5% of the time.

Second, getting AVs to work safely and reliably is much easier if their geographical range is limited to places that have been mapped in fine detail, such as city centres. So your first ride in an AV will be in a vehicle you hail using an app, not one you own.

Waymo, Alphabet’s AV effort, is testing a robotaxi service in Chandler, a suburb of Phoenix, and hopes to launch a commercial service later this year. Uber is operating driverless taxis in parts of Phoenix and Pittsburgh; users who hail a ride may find themselves being picked up by an autonomous car, supervised by an engineer (Uber gives riders the option to use an ordinary car instead if they prefer). Voyage, an AV startup, runs a robotaxi service in The Villages, a retirement community in San Jose, and is expanding to a second location, in Florida. Navya, a French startup, is operating an eight-seater autonomous shuttle bus in downtown Las Vegas, with three stops along a 1km (0.6 mile) route. It also has shuttles running in several other cities around the world, as does Easymile, a rival French firm. Large-scale deployments of AVs are most likely to start with geofenced robotaxi services in parts of cities such as Singapore or Dubai, and then expand over several years, predicts Nikolaus Lang of BCG.

It is likely to be many years before AVs are cheap enough for individuals to buy them, and capable enough to operate outside predefined, geofenced areas. Meanwhile, the roll-out of cheap robotaxis in urban areas might encourage many young urbanites, who are already going off car ownership anyway, to abandon it altogether. The combination of ride-hailing and autonomous-driving technology confronts carmakers with “the most profound challenge to their business models in a century”, declares a recent report from BCG. That is why carmakers are now piling into ride-hailing and car-sharing services and pushing on with their own AV programmes. In an autonomous future where ownership is optional, they need to be selling rides, not cars.

This shift offers carmakers a big opportunity. The car market is worth around $2trn a year globally, whereas the market for personal transport is worth as much as $10trn, according to Morgan Stanley, a bank. But it also exposes them to new competitors, in the form of technology companies and ride-hailing networks. Some carmakers have launched their own mobility services; others may prefer to act as fleet managers, providing capacity for ride-hailing operators and charging them by the mile. Some will even make “white label” fleets badged with the name of a city or a ride-hailing network, rather than their own brand.

Robotaxi fleets running around the clock will generate predictable yields that will appeal to institutional investors. Turning themselves into asset managers for such fleets would be a logical step for carmakers, whose finance arms are already involved in fleet management, says David Lesne of UBS.

Pricing models for users will change, too: Uber is already testing telecoms-like monthly price plans in some cities, which include a certain number of rides or miles for a fixed price, just as a mobile calling plan offers a certain amount of calls, texts and data.

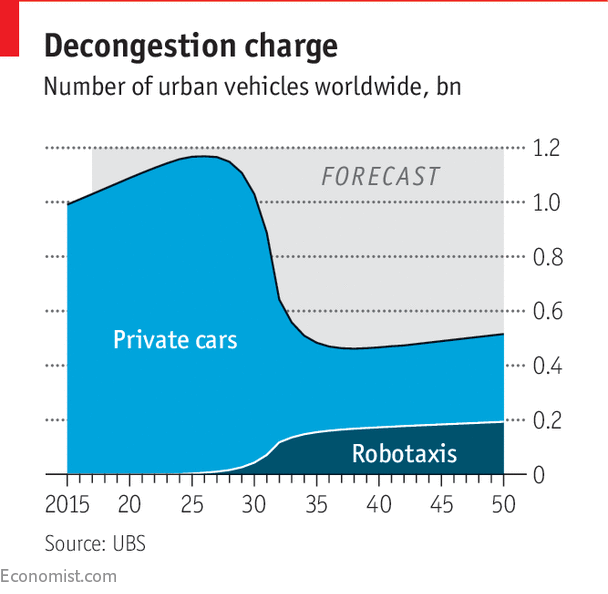

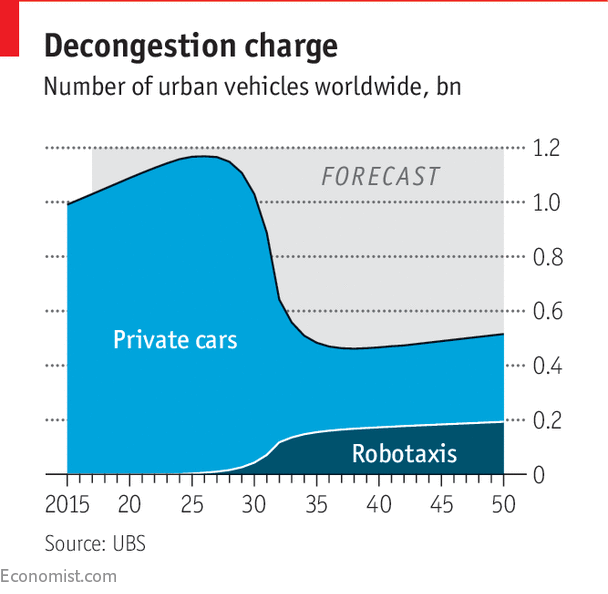

One big question is the effect of AVs on the number of vehicles sold worldwide per year, currently around 80m. Since most cars sit unused 95% of the time, switching to shared robotaxis that operate around the clock could greatly reduce the number of vehicles on the road. UBS reckons the global fleet size will halve by 2030 (see chart). But if robotaxis are in use 50% rather than 5% of the time, they will need to be replaced far more often, says Johann Jungwirth, chief digital officer of Volkswagen. So unless vehicle lifespans can be greatly extended, the number of new vehicles needed each year will rise.

Making vehicles reliably in large quantities is hard, as Tesla’s production problems have shown. “The core expertise that we’ve had for decades is excellent manufacturing,” says Ponz Pandikuthira, head of product planning for the European arm of Nissan. So even in a world of robotaxis, being a carmaker could still be a big business—just a different one from what it is today. After 130 years making hardware, says Mr Jungwirth, “we need to take software and services just as seriously.” That requires taking on new staff, retraining, acquisitions and partnerships. AVs will also accelerate the switch to electric vehicles, which have fewer components and need fewer assembly workers.

Form follows function

It will not just be carmakers that change shape; so will cars. Just as early “horseless carriages” resembled horse-drawn carriages, without the horse, most autonomous vehicles today are ordinary cars, retrofitted to drive themselves. But take away the need for a steering wheel and pedals, and AVs can assume a much wider range of shapes and sizes; Volkswagen’s Sedric and the Mercedes-Benz F015 are pods in which passengers sit facing each other. Future AVs may need to allow for some physical separation of passengers to encourage people to share vehicles with strangers, says Karl Iagnemma of nuTonomy, while families might hail a different vehicle that lets everyone sit together.

All this is bad news for car dealers. Most are barely profitable now and make their money from car financing and servicing, so even a small shift from car ownership to shared robotaxis could hit them hard. Repair shops and partsmakers could also suffer, assuming AVs reduce the number of car accidents. Already, some parts suppliers are listing AVs as a threat to their future profitability in regulatory filings. Insurers would be hit hard by a fall in private car ownership and fewer accidents. Health-care providers and personal-injury lawyers would also suffer if there were fewer accidents, though few will feel sorry for them.

People who drive taxis, delivery vehicles and trucks are most directly threatened by AVs. Uber and Lyft say they will continue to need human drivers on some routes for years to come, but driving jobs might be redefined rather than abolished. Delivery drivers could be employed to manhandle large packages into customers’ homes. Truck drivers might become overseers of platoons of vehicles travelling on highways. And AVs will create new jobs for remote fleet supervisors and mobile repair workers.

It already seems clear that AVs will cause the car industry and its adjacent businesses to change shape dramatically over the next couple of decades. But the consequences will not stop there. Like cars before them, AVs are sure to have far-reaching cultural and social effects too, most obviously in cities.

Courtesy of The Economist