A deep dive as automakers gear up to take on Google and Tesla

Ford, General Motors and Chrysler didn’t earn their iconic status by idling. As Tesla, Uber, Lyft and even Google aim to upend the automotive space, new business models are focused on more than just showing off the latest electric car models. Now, they’re doubling down on self-driving, connected cars that can send reams of data to marketers on where consumers are going and what they’re doing.

“When we think of digital transformations of car companies, it’s this real pivot from burning sheet metal and building motorized culture to selling mobility services that understand and help customers get around,” explained Frank Gillett, vp and principal analyst at Forrester Research. “Where CMOs are investing right now is with product and designing things into cars.”

Here is a deep dive into how emerging mar-tech capabilities will impact the automotive industry:

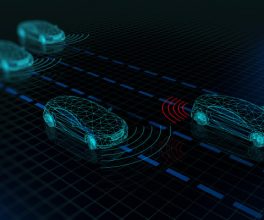

Driverless deals

No longer are self-driving cars just fodder for futurists—autonomous vehicle sales will reach 21 million by 2035, according to research firm IHS. Growing interest and new technologies also are helping to spur rival partnerships. “Companies that would have fought each other to the death are suddenly investing billions together to develop new technologies, whether it’s autonomous, electric or hydrogen,” said Paul Eisenstein, publisher of automotive news site The Detroit Bureau.

In September, Ford became the latest carmaker to sign on to Lyft’s driverless initiative, joining General Motors, which in 2016 invested $500 million in the venture (though it reportedly now may be moving to Lyft rival Uber) and Alphabet’s driverless development company Waymo. CapitalG–Alphabet’s venture investment arm–recently led a $1 billion funding round in the ride-sharing service.

This new business model is just the tip of the iceberg. Partnerships such as the Lyft venture are pegged to be valued at $144 billion over the next 10 years, per Accenture and the World Economic Forum’s Digital Transformation Initiative(DTI).

Connected cars

From streaming music and video to analyzing which coffee shop someone stops at every day on their commute, marketers are getting unprecedented amounts of data from connected cars.

Nissan and BMW are two notable brands that have gone all-in on partnering with tech firms like Apple’s CarPlay and Google’s Android Auto, which turn car dashboards into mini-entertainment centers. Meanwhile, Ford has its Ford Sync proprietary software, and Fiat Chrysler Automobiles’ Uconnect platform powers Wi-Fi, music, and a mobile app that can unlock the car remotely.

But we’re just at the starting gate. Data will soon be collected on consumers in connected cars—from how fast a car regularly goes, how many people are in a vehicle, and what apps passengers use—and can be layered on top of weather and location stats to decide where to build a new restaurant, for example. Over the next decade, connected cars stand to inject $117 billion into the automotive industry, per Accenture and the World Economic Forum’s DTI.

There’s also a strong tie between connected cars and loyalty, said Michael Ramsey, research director at Gartner. “Car companies have struggled for a long time with keeping a connection to the owners of the vehicles,” he said. “The dealer basically has that connection and when you have a connected car and you start to offer connected services, you maintain a connection with the consumer after they buy the car. The brands that do that better are stronger.”

Dissecting data

Perhaps at no other time since the early days of the automobile has the industry undergone such a dramatic transformation, touching all aspects of its business, from design and performance to the more recent frictionless, omnichannel approach that leads to a consumer’s decision to drive a car off the lot.

Over the next decade, that customer journey will be worth a whopping $263 billion in revenue and efficiency savings (defined as value) to the automotive industry, per Accenture and the World Economic Forum’s DTI. The key in all this will be how marketers leverage their data. Sixty percent of the car-buying process is spent online, but only 32 percent of consumers know what they’re looking for when they start their search, indicating that there’s a big opportunity for automakers to influence shoppers before they step foot in a dealership, according to research by Cox Automotive and IHS Automotive.

After years of keeping data pools separate from each other, brands such as Jaguar are developing new ways to mesh mobile, social media, and dealership data. They’re also partnering with Nielsen to test how creative impacts brand lift.

“We can track trends in the journey from advertising, news coverage, and events to website traffic, vehicle configurations, and requests for quotes all the way through to the retailer,” said Joseph Barbagallo, digital, social, and CRM manager at Jaguar Land Rover. “At the retail level, we correlate how many visits were driven by exposure to the advertising placement and match back to the sales data, so, all in all, we can evaluate where people come in and out of the journey, and tailor our sales and marketing efficiently.”