The global automotive re-manufacturing industry is undergoing rapid growth and changing at breakneck speed. As advanced new technologies sweep the industry, however, independent re-manufacturers and distributors stand the risk of being left behind if they do not find a way to partner with more established Original Equipment Manufacturers (OEMs).

Here, Managing Director Mike Rayne in FTI Consulting’s Automotive practice offers his perspective on how independents and Tier 1 manufacturers can benefit from “going to market” together in an article based on his presentations at the ReMaTec 2017 Convention in Amsterdam in June.

The automotive industry is entering a period of commercial and technological change not seen since the days of Henry Ford and mass production of the Model T. The car is no longer just a mode of transport. “Connected-vehicle” technology has created a new commercial environment that embraces both car and driver.

In fact, connected-vehicle technologies are changing the automotive industry in the same way the iPhone changed the mobile phone business: It’s opened the doors to allow third-party providers direct access to the motorist for an array of goods and services ranging from vehicle repair and entertainment to information and insurance.

This new commercial market has its challenges and risks, of course. Companies that want to be a part of the action need to get their key strategic and tactical planning in order now. Product strategy, channel management, distribution and organizational design are all critical elements that will drive success or failure.

A New Era for the Automotive Aftermarket

At a time when the automotive industry is increasingly connected to Silicon Valley, one of the biggest prizes is vehicle service and repair. The automotive aftermarket is a USD$550 billion global industry. Its growth is a function of the number of vehicles on the road and the age of those vehicles — both of which are increasing.

But the aftermarket is surprisingly inefficient, considering the auto manufacturing sector’s focus on, and success in, lean manufacturing. It is burdened with too much infrastructure and inventory; every community has an auto supply store whose shelves are filled with parts just waiting for demand to catch up with supply.

Just as technology has reshaped the car, so too is technology reshaping the way cars are serviced and parts are supplied. Telematics and predictive failure analysis are rapidly emerging as the cornerstones of future vehicle service. Companies that embrace these technologies will define the aftermarket of the future. Those who do not will be relegated to a failing model.

Remanufacturing: An Essential Element of the New Aftermarket Era

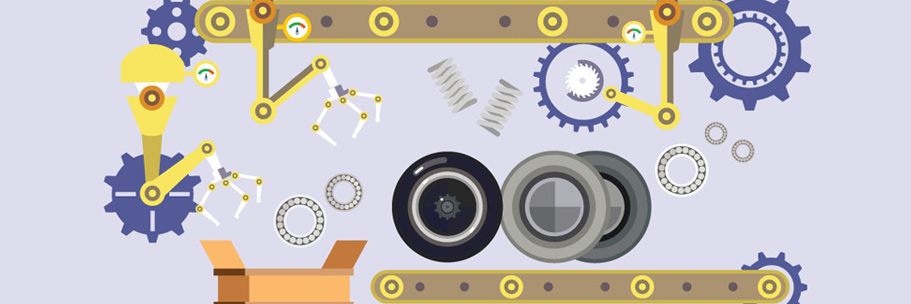

From a once under-capitalized market to a juggernaut opportunity based in advanced technology, remanufacturing has become a USD$43 billion industry.1

Historically, remanufacturing was focused on low-tech mechanical components (brakes, suspension, alternators, starter motors, water pumps, etc.); capital investment was relatively low and technological barriers were virtually nonexistent. But over the past 15 years, the content and complexity of vehicle technology has doubled, and sophisticated electronic products, often managed with proprietary software, have replaced simpler mechanical solutions.

Technology and third-party services offer new and profitable revenue streams, but to leverage those opportunities, the industry requires investments in engineering, product development, supply chain and process (e.g., order to cash, reverse logistics), organizational design, footprint rotation and new pricing models.

Proprietary IT and intellectual property (IP) present barriers to entry for independent remanufacturers and require changes in business models. Tier 1 manufacturers who own proprietary technologies and IP have assumed a more prominent position, raising the question: How do Tier 1 and independent companies co-exist in an increasingly complex, crowded space?

Succeed Together or Fail Alone

While technology has created challenges and disruption within the remanufacturing industry, it has also brought opportunities and real growth possibilities. By leveraging their combined strengths, market access and capabilities, OEMs and independents will fully realize the remarkable potential that the automotive market offers both.

Those seeking growth will need to adjust their business models accordingly. That means joining forces, each contributing their special strengths and expertise, to collaboratively address business challenges strategically and holistically. Collaboration, adaption, and integration are the new buzzwords, and those who adopt them as measures of success will take the lead. Those who do not will fall behind in an industry that is changing at hyperdrive speed.

Clearly, the rewards are well worth the effort as the industry is seeing success in both traditional and new relationships. A prime example is private equity (PE) investment. Within the remanufacturing sector alone, opportunities in the PE company sweet spot range from USD$10 million to USD$100 million. Of course, in a USD$43 billion sector in which highly profitable new technologies seem to arrive daily, the rewards are no secret. OEMs and independents are already racing to secure stakeholders via mergers, acquisition and partnerships.

For many, the vision of the new auto industry is represented by the autonomous vehicle discussion. But the reality is, the same level of innovation, change and speed is driving opportunity in sectors hidden from view.

PS:

The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates, or its other professionals.

Courtesy of FTI Consulting, Inc