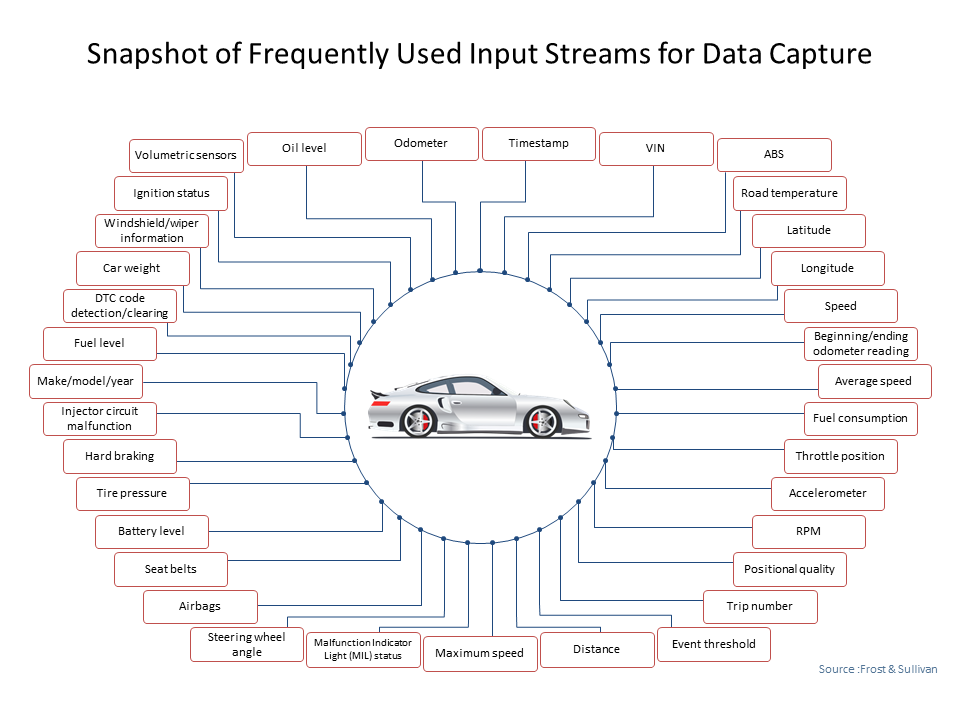

The connected car of today generates data from at least 200 different sensors within the vehicle and can profile everything from your location to driving habits. It can also monitor the use of vehicle features such as the temperature in your car and the weather in your surroundings.

A recently completed Frost & Sullivan report on “Data Monetization in Cars”, focusing on pricing and business models, indicates that if all the connected vehicles with the ability to capture certain data types were monetized, the overall opportunity would amount to ~$33 billion by 2025. This is huge, given that vehicle manufacturers are still evaluating use cases and data business models with an ecosystem of diverse skill sets.

Personalization using contextual data has become almost mandatory across all industries, be they retail, banking, healthcare, telecom or even sports. For example, Manchester City football club recently launched “Cityzens”, a digital platform that will utilize user data to offer a personalized experience for fans, while facilitating fan engagement. All these industries focus on various initiatives, placing data at the heart of managing disruption, and the auto industry is no different. However, not all car data points are of equal importance. Over 200 data points exist today, typically providing more than 140 viable use cases, but only 15% of these use cases are being monetized. Though use cases can be grouped under usage-based insurance (UBI), autonomous vehicles (AVs), crash reconstruction, location and mapping services, there are several kinds of uncharted potential. Use cases using location, driver behavior and vehicle use data (e.g. real-time location-based promotions, ride sharing specific insurance, digital car maintenance books) could find immediate monetization opportunities for the time spent in the car as an immediate RoI.

Of all the use cases out there that could be monetized, UBIs hold the highest potential, with an opportunity of $25-$40per car per year. This could range from pay as you drive (PAYD) to pay how you drive (PHYD) business models, which are the most preferred types of metrics to calculate insurance premiums. Companies like Octo Telematics have launched their Next Generation Platform allowing greater integration of data to enable third-party services such as tolling and traffic information. The idea here is to provide real-time data services to support a full digital transformation of the policyholder experience.

The study found three different pricing models. These are value-based, platform licensing, and revenue sharing. At present, revenue sharing pricing models are popular with car companies (e.g. otonomo’s Data Exchange and Marketplace platform). In terms of business models, there are again three key types of models within the industry; data bartering, brokering, and business intelligence.

The most popular model today is data bartering as most car companies and suppliers don’t know what to do with the data they have. This model typically involves information-based exchanges – data exchanges between Waze and city municipalities for example. However, some car companies are ahead of the curve. For example, BMW has launched its own data brokering marketplace model in Germany as a pilot called BMW CarData. In partnership with IBM, BMW follows a white-label service business model where ~8.5 million BMW vehicles have built-in telematics systems that operate using the open source CarData Platform. IBM’s Platform acts as a neutral server, gathering data from BMW vehicles and is stored in IBM’s BlueMix cloud platform. Every car company today is working on a business case for monetizing data. All are considering following BMW’s lead in setting up its own car data monetization platform.

An interesting independent data broker in the industry is otonomo, an Israeli- based start-up that has raised $37 million funding from seven investors. otonomo is the first of its kind car data marketplace and exchange platform. This platform is connected to databases of vehicle manufacturers (presently about nine), which the data is obtained from and normalized into one standard form, after which they anonymize and encrypt the data before it is delivered to their customers.

Car data customers can range from energy companies and fleet operators to retailers like Starbucks and McDonald’s, who want to know when you are likely to purchase your next coffee or burger. Frost & Sullivan identified over 50 different organizational types that want to profit from your vehicle, driving behavior and location data.

A smart person recently said that driving and owning a car will be free in the future as your data will be more valuable. I personally don’t agree with this but it does indeed have some value – about $100 per car to the car company, and much more to the companies who want to profit from you.

This article was written with contributions from Niranjan Manohar, Automotive IoT Program Manager in Frost & Sullivan’s Intelligent Mobility Practice.

Check out Frost & Sullivan’s report on data monetization and more on the future of mobility at www.frost.com/mobility.

Author – Sarwant Singh

Courtesy of Forbes